Nigerian bourse up 0.67% for the week

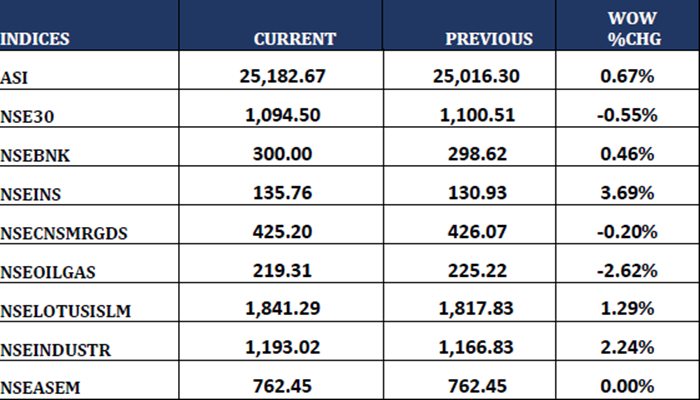

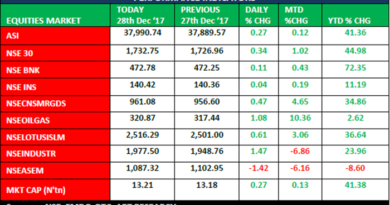

The Nigerian Stock Exchange (NSE) All-Share Index and Market Capitalization both appreciated by 0.67 per cent to close the week at 25,182.67 and N13.137 trillion respectively.

All other indices finished higher with the exception of NSE MERI Growth, NSE Consumer Goods and NSE Oil/Gas Indices which depreciated by 0.07 per cent, 0.20 per cent and 2.62 per cent respectively, while NSE ASeM closed flat.

Thirty-four (34) equities appreciated in price during the week, higher than Twenty-six (26) equities in the previous week. Thirty-one (31) equities depreciated in price, lower than Thirty-nine (39) equities in the previous week, while ninety-eight (98) equities remained unchanged, same as ninety-eight (98) equities recorded in the previous week.

It was a four-day trading week as the Federal Government of Nigeria declared Friday 12th June 2020 as Public Holiday to mark the Democracy Day celebrations.

Meanwhile, a total turnover of 1.103 billion shares worth N9.876 billion in 16,616 deals were traded this week by investors on the floor of the Exchange, in contrast to a total of 1.469 billion shares valued at N23.553 billion that exchanged hands last week in 22,911 deals.

The Financial Services industry (measured by volume) led the activity chart with 814.292 million shares valued at N7.186 billion traded in 8,352 deals; thus contributing 73.82% and 72.76% to the total equity turnover volume and value respectively. The Oil and Gas industry followed with 66.78 million shares worth N143.050 million in 1,044 deals. The third place was the Consumer Goods industry, with a turnover of 57.842 million shares worth N1.022 billion in 2,559 deals.

Trading in the top three equities namely Mutual Benefits Assurance Plc, Guaranty Trust Bank Plc and FBN Holdings Plc. (measured by volume) accounted for 485.307 million shares worth N5.048 billion in 2,683 deals, contributing 44.00% and 51.11% to the total equity turnover volume and value respectively.

A total of 767,768 units of ETPs valued at N5.607 billion were traded this week in 17 deals, compared with a total of 288,112 units valued at N3.994 million transacted last week in 9 deals.

Also, the Bonds Market recorded a total of 1,002 units at N971,140.42 during the week in 9 deals compared with a total of 2,785 units valued at N3.116 million transacted last week in 6 deals.

Meanwhile, Analysts at APT Securities and Funds Limited are of the view that the bearish trend experienced in the last two sessions of the week could possibly linger, a trend likely to dominate investors’ sentiments in the next trading week driving activity further downwards.

“We anticipate some sell off in the Healthcare sector in the coming week alongside some low capitalized stocks that have gained on corporate actions disclosure”.