NSE: Market capitalisation drops further by N2bn on Tuesday

The nation’s bourse extended negative mood on Tuesday with the market capitalisation dropping by two billion naira.

Speficially, the market capitalisation which opened at N12.913 trillion shed two billion naira or 0.02 per cent to close at N12.911 trillion.

Also, the All-Share Index lost 3.86 points or 0.02 per cent to close at 24,750.06 compared with 24,753.92 recorded on Monday.

The downturn was impacted by losses recorded in medium and large capitalised stocks, amongst which are; Dangote Sugar, Nigerian Breweries, PZ Cussons, Ecobank Transnational and Lafarge Africa

Analysts at Afrinvest Ltd said: “We continue to see sell pressures dominate the market as investor sentiment remains weak.

“Nonetheless, we maintain our mixed performance outlook for the week.”

The market breadth closed negative with nine gainers against 23 losers.

Unity Bank dominated the laggards’ table in percentage terms, losing 10 per cent, to close at 54k, per share.

Dangote Sugar followed with a decline of 9.85 per cent to close at N11.90, while Ikeja Hotel dipped 9.57 per cent to close at N1.04, per share.

Neimeth International lost 9.35 per cent to close at N1.26, while Chams shed 8.70 per cent to close at 21k, per share.

On the other hand, UACN Property led the gainers’ table in percentage terms, gaining 7.69 per cent, to close at 98k, per share.

Transcorp followed with 2.86 per cent to close at 72k, while Oando appreciated by 2.04 per cent to close at N2.50, per share.

MTN Nigeria Communications increased by 1.64 per cent to close at N118, while Flour Mills rose by 1.52 per cent to close at N20, per share.

A breakdown of the activity chart shows that Japaul Oil and Maritime Services was the toast of investors, accounting for 25.01 million shares valued at N6.65 million.

FBN Holdings followed with 12.05 million shares worth N63.24 million, while Guaranty Trust Bank traded 11.17 million shares valued at N253.46 million.

FCMB Group traded 10.76 million shares worth N19.36 million, while United Bank for Africa transacted 9.75 million shares valued at N61.70 million.

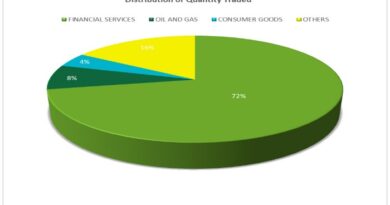

In all, investors bought and sold 167.95 million shares, worth N1.55 billion and exchanged in 3,784 deals, an increase of 34.7 per cent.

This was against a turnover of 124.69 million shares valued at N1.32 billion transacted in 3,843 deals on Monday.