Equities on Nigerian bourse down 1.99% for the week

The Nigerian Stock Exchange (NSE) All-Share Index and Market Capitalization both depreciated by 1.99 per cent to close the week at 24,336.12 and N12.695 trillion respectively. All other indices finished lower

A total of 13 equities appreciated in price during the week, lower than 18 in the previous week while 59 depreciated in price, higher than 43 in the previous week, while 91 equities remained unchanged, lower than 102 equities recorded in the previous week.

A total turnover of 961.833 million shares worth N9.181 billion in 20,058 deals were traded this week by investors on the floor of the Exchange, in contrast to a total of 739.375 million shares valued at N8.563 billion that exchanged hands last week in 17,248 deals.

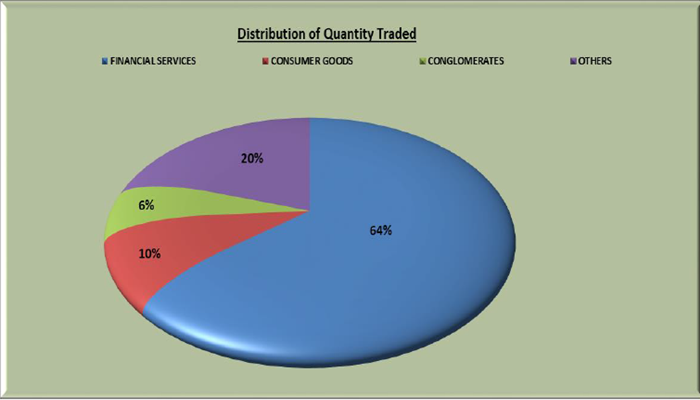

The Financial Services industry (measured by volume) led the activity chart with 618.714 million shares valued at N4.338 billion traded in 9,669 deals; thus contributing 64.33% and 47.25% to the total equity turnover volume and value respectively.

The Consumer Goods industry followed with 91.119 million shares worth N2.227 billion in 3,703 deals. The third place was the Conglomerates industry, with a turnover of 60.640 million shares worth N62.779 million in 556 deals.

Trading in the-top three equities namely FBN Holdings Plc, Guaranty Trust Bank Plc and United Bank for Africa Plc. (measured by volume) accounted for 275.099 million shares worth N2.818 billion in 3,497 deals, contributing 28.60 per cent and 30.69 per cent to the total equity turnover volume and value respectively.

A total of 358,114 units of ETP valued at N1.912 billion were traded this week in 25 deals, compared with a total of 199,011 units valued at N1.525 billion transacted last week in 13 deals.

A total of 4,590 units of Bonds valued at N5.515 million were traded this week in 14 deals compared with a total of 9,284 units valued at N10.180 million transacted last week in 8 deals.

A total volume of 6,200,000 units of LAPO MFB SPV Plc’s N6.2billion 13.00 per cent Fixed Rate Series 2 Senior Unsecured Bonds Due 2025 Under the N20billion Debt Issuance Programme were admitted to trade at The Exchange on Monday 29th June, 2020.