UBA is lead arranger for NNPC’s $1.5bn facility to boost oil production, govt revenue

The United Bank for Africa Plc (UBA), the leading pan-African financial services group, has acted as the lead arranger of a consortium of Nigerian commercial and international banks in a $1.5 billion pre-export finance facility for the Nigerian National Petroleum Corporation (NNPC) and its upstream subsidiary, the Nigerian Petroleum Development Company (NPDC).

Also, the bank is providing $200 million (Naira equivalent) to support investment growth and liquidity requirements. The facility according to a statement from the bank will provide much-needed capital for investment in NNPC’s production capacity, which is of strategic importance to the Nigerian economy and the country’s leading source of foreign exchange earnings.

UBA’s position as lead arranger recognises the Group’s strength in structuring and deploying financing to the oil and gas sector, and the depth and liquidity of the bank’s balance sheet. The $1.5 billion facilities it said, is structured in two tranches. The first tranche of $1 billion to be repaid over a period of five years will be provided in dollars, with UBA acting as the facility agent bank. The second tranche of $500 million will be provided in a local currency, over seven years, with UBA acting as lead bank, providing $200 million in Naira equivalent.

Both facilities will be repaid from an allocation of 30,000 barrels per day of NPDC’s crude oil. UBA has a strong track record in the resources sector across Africa, having facilitated oil prepayment deals with the NNPC, including its 2013 $100 million participation in the PXF Funding Limited transaction, and a further $60 million in the 2015 Phoenix Export Funding Limited transaction.

In Senegal, UBA was responsible for the EUR 240million revolving crude oil financing facility for the Société Africaine de Raffinage and in Congo Brazzaville co-funded the $250million crude oil prepayment facility for Orion Oil Limited.

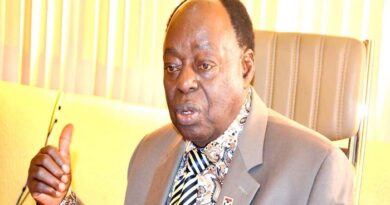

Other participants in the NNPC deal include Standard Chartered Bank, Afrexim Bank, Union Bank and two oil trading companies, Vitol and Matrix. Speaking on this most recent support for Nigeria’s petroleum industry, UBA Group Chairman, Tony O. Elumelu stated ‘This has been one of the most economically challenging years that Nigeria has witnessed. With the sharp drop in the price of oil and the ensuing hardship that followed the onset of the Covid-19 pandemic, the private sector must come together and contribute meaningfully to the economy.