A turnover of 1.263 billion shares worth N10.759 billion in 19,975 deals were traded in the week by investors on the floor of the Exchange, in contrast to a total of 887.037 million shares valued at N9.193 billion that exchanged hands last week in 17,837 deals.

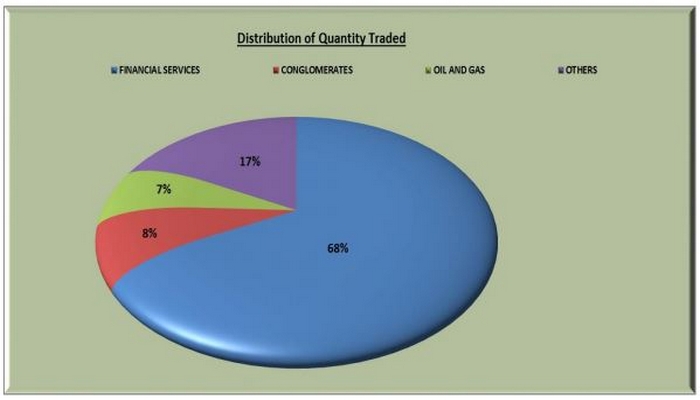

The Financial Services Industry (measured by volume) led the activity chart with 853.125 million shares valued at N6.754 billion traded in 11,127 deals; thus contributing 67.56 per cent and 62.78 per cent to the total equity turnover volume and value respectively.

The Conglomerates Industry followed with 103.226 million shares worth N704.563 million in 954 deals. The third place was Oil and Gas Industry, with a turnover of 89.472 million shares worth N353.533 million in 1,479 deals.

Trading in the top three equities namely Fidelity Bank Plc, FBN Holdings Plc and Access Bank Plc (measured by volume) accounted for 390.775 million shares worth N2.021 billion in 3,241 deals, contributing 30.94 per cent and 18.78 per cent to the total equity turnover volume and value respectively.

A total of 671,160 units of ETPs valued at N2.507 billion were traded in the week in 76 deals compared with a total of 361,254 units valued at N1.909 billion transacted last week in 29 deals.

Also, a total of 60,714 units of Bonds valued at N73.497 million were traded in the week in 17 deals compared with a total of 44,303 units valued at N55.333 million transacted last week in 13 deals.

The NSE All-Share Index and Market Capitalization depreciated by 0.15 per cent and 0.12 per cent to close the week at 38,808.01 and N20.310 trillion respectively.

All other indices finished lower with the exception of NSE Premium, NSE Lotus II, NSE Industrial and NSE Sovereign Bond Index which appreciated by 0.65 per cent, 0.09 per cent, 0.95 per cent, and 0.17 per cent while the NSE ASeM and NSE Growth Indices closed flat.

A total of 18 equities appreciated in price during the week, higher than 17 in the previous week even as 47 equities depreciated in price higher than 40 in the previous week, while 97 remained unchanged, lower than 105 equities recorded in the previous week.