Forex: Financial expert urges CBN to exercise caution on BDCs ban

A Financial Expert, Mr Okechukwu Unegbu, has urged the Central Bank of Nigeria (CBN) to be cautious of its recent “blanket’’ ban placed on Bureau de Change (BDC) operators from foreign exchange (forex) trading.

Unegbu, a past President of the Chattered Institute of Bankers of Nigeria (CIBN), made the call in an interview with the News Agency of Nigeria (NAN) on Wednesday in Abuja.

He said that the ban would create some challenges in the market as commercial banks might not be able to meet the forex demands of importers.

According to Unegbu, commercial banks themselves are not perfect, as some of them also flout forex regulations.

“This punitive measure by the CBN can negatively affect the forex trading market.

“Most businessmen, when they cannot access forex from commercial banks, rush to the BDCs.

“Banks are not perfect, they also bend the rule sometimes, but that of the BDCs became so obvious due to their large numbers.

“The Naira has been so bastardised and it is good to see that the CBN is acting to remedy the situation,’’ he said.

Unegbu said that athough some of the BDCs were involved in unwholesome practice there were still some BDCs that operated above board.

He said that the move by the apex bank was only a step toward resolving the abuse in the forex market and to reduce pressure on the Naira.

“There had been a lot of misgivings about forex in the country but this blanket ban by the CBN is just a step towards the solution.

“Not all the BDCs are bad, but as it is now CBN has banned both the good and he bad.

“But it is a warning to the Association of Bureaux De Change Operators of Nigeria (ABCON).

“ABCON should find a way to make amends and reign in on some of the operators that abuse the system,’’ he said.

The News Agency of Nigeria (NAN) reports that the CBN announced immediate discontinuation of forex to the BDCs.

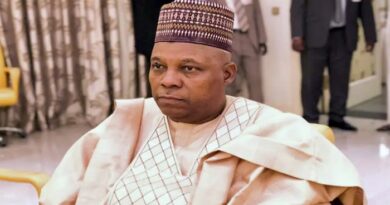

CBN Governor, Mr Godwin Emefiele, who made the announcement during the banks 280th Monetary Policy Committee (MPC) meeting, said that the BDC operators were involved in rent-seeking behaviour money laundering activities.

Emefiele added that BDCs were to serve the retail end users who needed 5,000 dollars or less, but had defeated their purpose of existence to provide forex to retail user.

He also said that BDCs had instead become wholesale and illegal dealers.