Investors trade 1.026bn shares at an12.257bn for the week

A total turnover of 1.026 billion shares worth N8.183 billion in 18,102 deals were traded this week by investors on the floor of the Exchange, in contrast to a total of 866.544 million shares valued at N12.257 billion that exchanged hands last week in 17,291 deals.

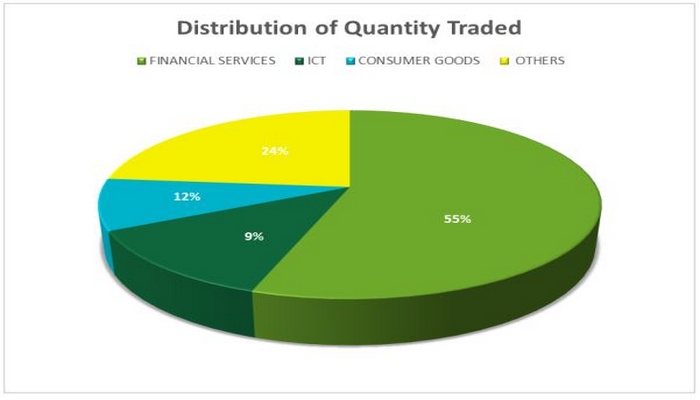

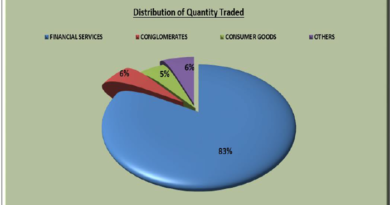

The Financial Services Industry (measured by volume) led the activity chart with 567.225 million shares valued at N3.658 billion traded in 7,970 deals; thus contributing 55.30% and 44.70% to the total equity turnover volume and value respectively.

The ICT Industry followed with 126.638 million shares worth N1.164 billion in 1,073 deals. The third place was Consumer Goods, with a turnover of 90.497 million shares worth N1.454 billion in 3,344 deals.

Trading in the top-three equities namely Sovereign Trust Insurance Plc, Mutual Benefits Assurance Plc Transnational Corporation of Nigeria Plc (measured by volume) accounted for 247.735 million shares worth N114.399 million in 809 deals, contributing 24.15% and 1.40% to the total equity turnover volume and value respectively.

A total of 39,465 units of ETP valued at N1.834 million were traded this week in 27 deals compared

with a total of 1.001 million units valued at N16.762 million transacted last week in 14 deals.

Investors in the Bonds markrt traded a total of 26,861 units valued at N27.503 million this week in 17 deals compared with a total of 30,877 units valued at N31.842 million transacted last week in 14 deals.

The NGX All-Share Index and Market Capitalization appreciated by 0.01% to close the week at 39,485.65 and N20.573 trillion respectively.

All other indices finished lower with the exception of NGX Premium, NGX Banking, NGX Insurance, NGX AFR Div Yield, NGX Meri Value and NGX Oil & Gas indices which appreciated by 0.07%, 0.30%, 1.06%, 0.02%, 0.15%, and 0.08% respectively, while the NGX ASeM, NGX Growth and NGX Sovereign Bond Indices closed flat.

A total of 35 equities appreciated in price during the week, lower than 36 in the previous week. even as 29 equities depreciated in price, lower than 33 in the previous week, while ninety-two (92) equities remained unchanged higher than 87 recorded in the previous week.