Transport, Honeywell, FBN Holdings account for 68% turnover

Trading in the top-three equities namely Transcorp Hotels Plc, Honeywell Flour Mill Plc and FBN Holdings Plc (measured by volume) accounted for 1.494 billion shares worth N6.944 billion in 1,017 deals, contributing 68.33 per cent and 42.91 per cent to the total equity turnover volume and value respectively.

A total of 160,433 units valued at 52.347 million were traded this week in 23 deals compared with a total of 9,728 units valued at N437,821.70 transacted last week in 18 deals.

The market opened for four trading days this week as the Federal Government of Nigeria declared Friday 1st October 2021 a Public Holiday to mark the Nations 61st Independence Anniversary

A total turnover of 2.187 billion shares worth N16.183 billion in 14,377 deals were traded this week by investors on the floor of the Exchange, in contrast to a total of 1.290 billion shares valued at N13.921 billion that exchanged hands last week in 16,745 deals.

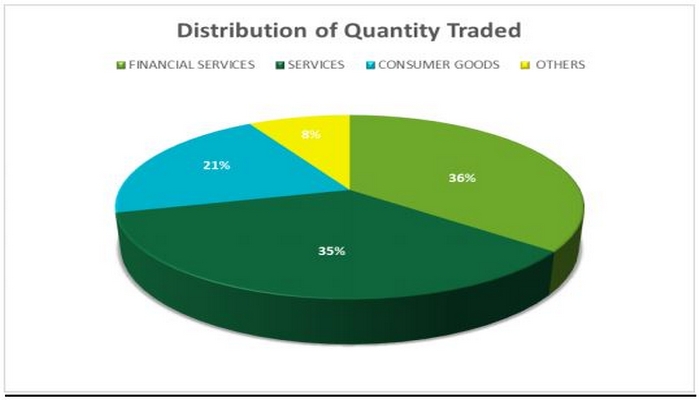

The Financial Services Industry (measured by volume) led the activity chart with 778.434 million shares valued at N5.591 billion traded in 7,183 deals; thus contributing 35.60% and 34.55% to the total equity turnover volume and value respectively. The Services Industry followed with 775.712 million shares worth N2.909 billion in 416 deals.

The third place was Consumer Goods Industry, with a turnover of 448.662 million shares worth N3.999 billion in 2,257 deals.

A total of 41,267 units of Bonds valued at N42.568 million were traded this week in 17 deals compared with

a total of 60,929 units valued at N62.810 million transacted last week in 27 deals.

The NGX All-Share Index and Market Capitalization appreciated by 3.23 per cent and 3.57 per cent to close

the week at 40,221.17 and N20.956 trillion respectively.

Similarly, all other indices finished higher with the exception of NGX Insurance index which depreciated by 7.58 per cent, while the NGX ASeM and NGX Growth Indices closed flat.

A total of 33 equities appreciated in price during the week, higher than 28 in the previous week, even as 22 equities depreciated in price, lower than 23 in the previous week, while 100 equities remained unchanged

lower than 104 recorded in the previous week.