MAN cries against increase in MPR, CRR, says tougher times await nation’s manufacturing sector

The Manufacturing Association of Nigeria (MAN) has faulted the recent increase of the Monetary Policy Rate (MPR) and Cash Reserve Requirement (CRR), by the Central Bank of Nigeria (CBN), stressing that it portends tougher times for the nation’s manufacturing sector.

The Monetary Policy Committee (MPC) of the CBN in Communique No. 144 of the third quarter 2022 meeting, increased the MPR by 150 base points to 15.5 per cent with an asymmetric corridor of +100/-700 basis points around the MPR and the CRR by 750 base points to 32.5 per cent, while retaining Liquidity Ratio at 30 per cent.

According to the Committee, the increase was aimed at moderating the high inflationary pressure on the economy and narrow the gap between the hitherto MPR of 14 a per cent and inflation rate which stood at 20.52 per cent in August 2022 in order to improve the level of real interest rate.

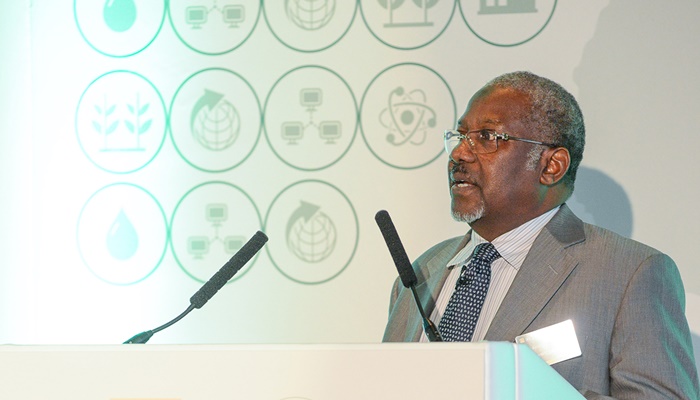

MAN, having acknowledged the importance of real interest rate to prospective investors, desirous of optimising their investment earnings, the association, in a statement signed by its Director General, Mr Segun Ajai-Kadir, argued that the implications of such increase were grievous.

According to the body, one of such is that it might result in increased cost of borrowing by manufacturers, further beyond the extant double-digit rate, a development, it argued, might disincentivize new investments in the sector.

The association further argued that such increase might lead to high product prices, thereby making the sector uncompetitive.

“The high product prices might make patronage to plummet, thereby leading to huge inventory of unsold manufactured products in the sector.

“High inventory of manufactured products will trigger reverse effect in the sector as manufacturing capacity utilization, production, employment, profit and tax contribution to national building will decline. “In consideration of the prevailing scenario around increase in interest rate and access to funds, tougher times are ahead for the productive sector.

“Clearly, the increase in MPR from 14 per cent to 15.5 per cent will rub-off negatively on other rates and dash the hope for a single digit lending rate for the productive sector in the economy.

“Moreover, the observed continuous contractionary monetary policy posture without complementary fiscal support may not effectively reduce the prevailing inflationary pressure on the economy,” it argued.

MAN, therefore, called on the monetary authority to strategically set in motion mechanism for wholistic balancing of the real interest rate, which, it argued, is critical to investment, and not just following leading economies to adjust interest rate without considering domestic peculiarities.