Investors on Nigeria bourse traded N22.710bn shares for the week

A total turnover of 944.293 million shares worth billion in 18,615 deals was traded this week by investors on the floor of the Exchange, in contrast to a total of 3.789 billion shares valued at N27.500 billion that exchanged hands last week in 20,333 deals.

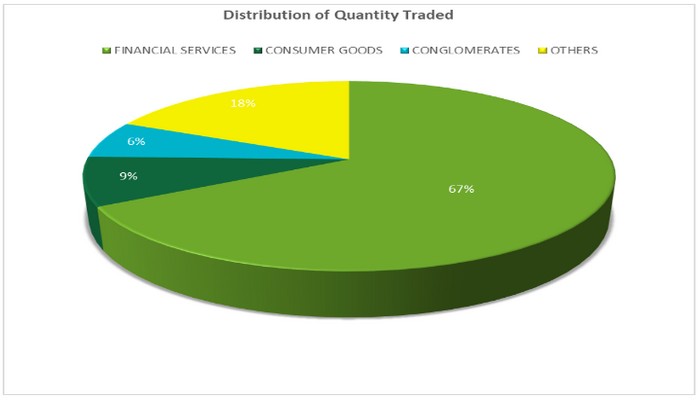

The Financial Services Industry (measured by volume) led the activity chart with 634.086 million shares valued at N6.442 billion traded in 8,540 deals; thus contributing 67.15% and 28.37% to the total equity turnover volume and value respectively.

The Consumer Goods Industry followed with 78.603 million shares worth N2.218 billion in 2,993 deals. The third place was the Conglomerates Industry, with a turnover of 59.564 million shares worth N110.109 million in 788 deals.

Trading in the top three equities namely Guaranty Trust Holding Company Plc, Universal Insurance Plc and Transnational Corporation Plc. (measured by volume) accounted for 269.288 million shares worth N2.999 billion in 1,845 deals, contributing 28.52% and 13.21% to the total equity turnover volume and value respectively.

A total of 16,674 units of ETP valued at N11.982 million were traded this week in 44 deals compared with a total of 1.082 million units valued at N11.738 million transacted last week in 62 deals.

The Bonds sector traded a total of 45,882 units valued at N46.200 million were in 22 deals compared with a total of 31,683 units valued at N32.251 million transacted last week in 35 deals.

The NGX All-Share Index and Market Capitalization appreciated by 0.21% to close the week at 54,327.30 and N29.591 trillion respectively.

All other indices finished lower with the exception of NGX 30, NGX Premium, NGX AFR Div. Yield, NGX Oil and Gas, NGX Lotu II, and NGX Industrial Goods indices which appreciated by 0.34%, 1.04%, 0.50%, 0.63%, 0.51 and 0.65% respectively while the NGX ASeM and NGX Sovereign Bond indices closed flat.

A total of 24 equities appreciated in price during the week, lower than 55 in the previous week as 45 equities depreciated in price higher than 27 in the previous week, while 88 equities remained unchanged, higher than 75 equities recorded in the previous week.