FinTech remains key driver for financial inclusion – NCC, experts

The Nigeria Communications Commission (NCC) has described the Financial Technology (FinTech) industry as a major driver for financial inclusion of the underserved and unserved communities across the country.

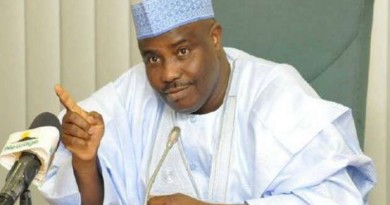

The Executive Vice Chairman (EVC), NCC, Dr Aminu Maida, made this known at the Nigeria Information Technology Reporters Association (NITRA) FinTech Forum on Thursday in Lagos.

Maida spoke on the theme: ‘’Harnessing Nigeria’s Fintech Potential: Challenges and Opportunities.”

The EVC who was represented at the event by Controller, NCC Lagos Zonal Office, Mr Henry Ojiokpota said the theme of the event was topical in the financial industry considering the significant rise in digital financial services.

According to him, FinTech is gradually revolutionising Nigeria’s financial ecosystem as it poses a great disruption to the conventional financial system.

Maida said the importance of the emerging industry that leveraged technology to support several financial services such as mobile banking, borrowing and investment cannot be overemphasised.

‘’FinTech comes with a lot of business opportunities in terms of innovation, job creation and investment.

‘’Therefore, FinTech has the potential to deepen the existing payment and financial system infrastructure to reach unserved and underserved areas and further stimulate economic growth,’’ he said.

According to him, digital financial services will continue to have a significant impact on Nigeria’s financial inclusion and the digital economy at large.

He said: “it is because of the optimal utilisation of digital technologies in the provision of financial services to rural communities and underserved segments of the population.”

Maida said with the youthful population accounting for an estimated 70 per cent of Nigeria’s population, the digitally savvy, young individuals adopting these FinTech applications for socioeconomic gains would boost economic growth and development.

Also speaking, the Head of Partnership, Moniepoint Inc, Mr Ogie Efemena, said payment space was doing fantastically well.

Efemena disclosed that two billion transactions were undertaken within the FinTech space in 2022.

He, however, noted that the figure was small when compared with the country’s population at 230 million according to the National Population Commission.

Efemena commended NITRA for coming up with such an event, stressing that the initiative should be more consistent to address the industry challenges.

In his welcome address, the Chairman of NITRA, Mr Chike Onwuegbuchi, said FinTech had become the most exciting sector in the Information Communication Technology industry, and Nigeria, as a whole.

“The focus on a sector that is seen as the engine of financial dealings, economic growth and transactional unification, is touted to present and aid various other sectors from the grassroots to international business and trade,” he said.

He said there was a slowdown in FinTech funding in the past few years according to a Partech Africa’s tech Venture Capital Report of 2022.

Onwuegbuchi said the report showed that Nigeria recorded $798 million in 2022 from $1.3 billion achieved in 2021.

He said the forum would address some of the challenges affecting the growth of FinTech in the country.