Access Bank partners ASOLAR to power up Nigerian SMEs and rural communities with eco-friendly energy solutions

Access Bank Plc, in collaboration with Asolar, has launched a green energy solution to tackle power supply challenges faced by small and medium enterprises and rural communities across the country.

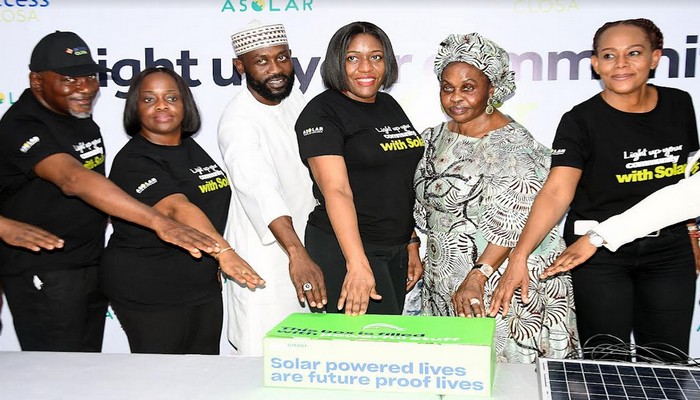

The products, which included solar-powered TV sets, Air Conditioners, and PoS machines, among many others, were launched on Tuesday at the Access Bank Branch in Garki, Abuja.

Speaking during the unveiling ceremony tagged: ‘Light up your community’, the Access Bank Deputy Managing Director, Victor Etuokwu, said the inconsistent power supply has become a major obstacle to businesses and livelihoods in the country.

Represented by the bank’s Director of Regional services, Neka Adogu, Mr Etuokwu said the initiative was aimed at promoting financial inclusion in rural areas.

He said: “This inconsistent power supply poses a substantial challenge for small and medium enterprises [SMEs] as well as initiatives aimed at promoting financial inclusion in rural areas, which is considered a yardstick for economic growth in Nigeria.

“Currently, in Nigeria, owners of SMEs and people living in rural communities with no or little power supply, spend huge sums in procuring generating sets, purchasing fuel, and the maintenance of generators to operate their business successfully.

“Furthermore, in the broader context of financial inclusion, the absence of power accessibility becomes a critical barrier.

“Dependable electricity is a fundamental prerequisite for implementing modern financial services like digital banking and payment systems, particularly in underserved rural areas.

“This disparity in power access widens the financial gap, impeding initiatives aimed at providing banking and financial services to those who are most in need.

“Through this partnership, we embark on a transformative journey to introduce cost-effective and dependable solar-powered solutions tailored specifically for small and medium businesses.

“By harnessing the potential of solar energy, we aim to untether these businesses from the shackles of unreliable power sources and offer promising alternatives to traditional generators reliant on expensive and polluting fossil fuels.

“By providing access to affordable solar-powered solutions, we endeavour to significantly reduce operational costs, enhance productivity and catalyse growth for these enterprises.

“Access Bank PLC’s collaboration with ASOLAR is not merely transforming power solutions; it is utilising our Access CLOSA Agent Network platform as the digital payment provider,” he said.

In his remarks, the Chief Executive Officer of Asolar, Hakeem Shagaya, said the company was committed to ensuring every citizen has access to reliable and sustainable energy across the country.

While appreciating the management of the bank for the collaboration, Mr Shagaya noted that the initiative was in line with the sustainable development goals on clean and renewable energy.

“As we embark on this journey towards Access Green Energy, let us not overlook the profound impact on our environment. This initiative is not just about illuminating homes; it is about lighting the way for a greener and cleaner tomorrow.

“The Solar Home Systems represent a commitment to environmental stewardship, reducing carbon footprints, and actively contributing to the global fight against climate change.

“The positive environmental impact extends beyond emissions reduction, encompassing the preservation of ecosystems, the promotion of biodiversity and the creation of a more sustainable and resilient planet for future generations.

In her remark, Chizoba Iheme, Group Head, Financial Inclusion, Access Bank Plc, disclosed that the bank has over 300,000 Access agents across the country to facilitate the distribution across Nigeria.

The initiative is generally geared towards proffering a lasting solution to the problem of power (light) faced by SMEs across Nigeria; especially those situated in rural areas. It is predominantly expected to enhance business sustainability and growth amongst SMEs across Nigeria.