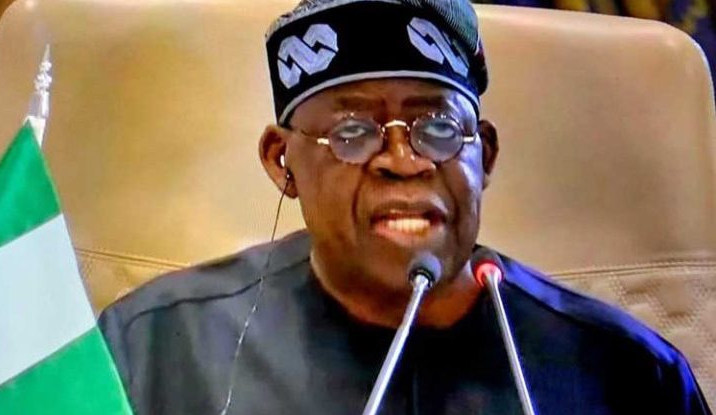

President Bola Tinubu has signed into law four groundbreaking tax reform bills that would transform Nigeria’s fiscal and revenue framework.

The four tax reform bills recently passed by the National Assembly were signed at a ceremony held at the Presidential Villa on Thursday.

The ceremony was witnessed by top government officials including the President of the Senate, Godswill Akpabio, the Speaker of the House of Representatives, Tajudeen Abbas the Senate and House Majority Leaders, as well as chairmen of the Senate and House Committees on Finance.

Also in attendance were the Chairman of the Nigeria Governors’ Forum and Kwara state governor, Abdulrazaq AbdulRahman, the Chairman of the Progressive Governors’ Forum and Imo state governor, Hope Uzodimma, the Minister of Finance and Coordinating Minister of the Economy, Wale Edun, and the Attorney General of the Federation, Lateef Fagbemi, SAN.

The four bills —the Nigeria Tax Bill, the Nigeria Tax Administration Bill, the Nigeria Revenue Service (Establishment) Bill, and the Joint Revenue Board (Establishment) Bill —were passed by the National Assembly after extensive consultations with various interest groups and stakeholders.

Speaking at the ceremony, President Tinubu said the bills reflect his administration’s resolve to create a modern, transparent, and efficient tax system capable of supporting national development, promoting investment, and reducing the burden of multiple taxation on citizens and businesses.

The Nigeria Tax Bill (Ease of Doing Business) consolidates Nigeria’s fragmented tax statutes into a unified legal framework. It seeks to reduce tax duplication, enhance clarity, and ease compliance for taxpayers.

The Nigeria Tax Administration Bill provides a harmonized legal and operational structure for tax administration at the federal, state, and local government levels, aiming to foster efficiency and uniformity in tax collection.

The Nigeria Revenue Service (Establishment) Bill repeals the existing Federal Inland Revenue Service (FIRS) Act, paving the way for the establishment of a new, performance-driven Nigeria Revenue Service (NRS) with expanded responsibilities, including non-tax revenue collection. The bill also introduces strong mechanisms for accountability and transparency.

The Joint Revenue Board (Establishment) Bill sets up a national governance structure to coordinate tax efforts across all tiers of government.

It also introduces a Tax Appeal Tribunal and an Office of the Tax Ombudsman, enhancing taxpayer rights and dispute resolution mechanisms.

Earlier on Thursday, President Tinubu had explained that the laws would be unifying Nigeria’s fragmented tax system, remove redundant overlaps, boost investor confidence, enhance transparency, and promote coordinated efforts across all levels.

He also described the legislation as a clear departure from previous policies, emphasising that the reforms are designed to ease the burden on working families, small businesses, and low-income earners while eliminating inefficiencies that have long plagued Nigeria’s fiscal structure.

On his verified X handle @officialABAT, the President had said that the new tax laws form the groundwork for the Nigeria of tomorrow, focused on unlocking opportunities for all.

“We are also building a framework for the Nigeria of tomorrow-leaner, fairer and laser focused on unlocking opportunities for all.”

The Nigerian Leader explained that with the new tax reform laws, the Bola Tinubu led Administration is now laying the foundation for a tax regime that is fair, transparent and fit for a modern, ambitious Nigeria.

“These reforms go beyond streamlining tax codes. They deliver the first major, pro-people tax cuts in a generation, targeted relief for low-income earners, small businesses, and families working hard to make ends meet.

“For too long, our tax system has been a patchwork-complex, inequitable, and burdensome. It has weighed down the vulnerable and shielded inefficiency. That era ends today.

“We are laying a foundation for a tax regime that is fair, transparent and fit for a modern, ambitious Nigeria.

“A tax regime that rewards enterprise, protects the vulnerable, and mobilises revenue without punishing productivity,” he said.